Marble Quarry

BUSINESS PLAN VOMARTH MARBLE QUARRY

Via di San Sebastianello 5

I-00184 Rome, Italy

Based near Rome, this Italian-based company quarries, manufactures, and distributes its own world-renowned marble. Recently the firm sought out additional monies to market directly to consumers, architects, and designers living in the United States as it recognized how American Baby Boomers are craving more upscale luxury products (including marble) in their lives. This plan persuaded numerous investors to give the company US$6 million to start a vitally important new distribution operation in the United States.

- VOMARTH SNAPSHOT

- THE COMPANY: HISTORICAL BRIEF

- THE OPPORTUNITY

- THE STRATEGY

- STRATEGY SNAPSHOT

- MARKETING STRATEGY

- MARKET & PRODUCT ANALYSIS

- COMPETITIVE ANALYSIS

- EXECUTIVE MANAGEMENT

- FINANCIAL SUMMARY

VOMARTH SNAPSHOT

Management:

Ed Mastian, CEO

Bonnie Slinger, CFO & COO

Chuck Wilson, Quarry Master

Nicholas Kitt, Production Manager

Board of Directors:

Jeff DiMuzio (Italy)

Brian Davis (England)

Michael Thompson (United States)

Jimmy Duthow (United States)

Frank Steinker (Germany)

John O'Reilly (Ireland)

Industry: Dimensional stone

Web Design: Proactive

Bank: PNC Bank

Accountant: Anderson Accounting

Use of funds: Acquisitions, distribution, marketing/sales, products diversification

Current investors: US$6 million Private Investors, Personal Funds, Operations Proceeds

Current Valuation: US$65+ million

Business Description: Vomarth quarries, manufactures, and distributes its own various colors and grades of marble. Its unique products are used for purpose of construction and renovation. Currently, its natural stone products are manufactured in Ireland and distributed in most major areas of the U.S. and parts of Europe.

The company plans to consolidate the traditionally fragmented industry through developing retail stores. This will allow them to brand a portfolio of marble and natural stone products, which will be recognized and trusted throughout the world for its quality. Vomarth will earn in the stone industry the status that Andersen Windows established among the manufacturers of custom windows.

The company will acquire stone retail/fabrication businesses that have been identified and qualified by the company's acquisition team. The acquisitions will have proven track records of profitable sales and will be the dominant (or have the possibility to be the dominant) stone business in their market area.

Market Needs: The market currently has the following needs:

- Consumers have no well-known brand name to trust when they go to buy stone. We intend to brand the totality of the stone buying experience and exploit this opportunity in the market.

- Localized sales by a nationally trusted name.

- Once the decision is made to have a granite counter top, the consumers want it immediately. We will satisfy this need.

Market Opportunity: Note that every new construction site or existing commercial/ residential building has a need for dimensional stone products. Floor Covering Weekly estimates that the retail floor covering market alone, being the most profitable segment of dimensional stone industry, is estimated at US$40.8 billion with the typical residential customer spending between $2,000 to $5,000 for stone work per kitchen and $2,000 to $5,000 per bathroom.

In tandem with this highly profitable market, the company will achieve US$600 million in annual sales of its natural stone products with a short-term goal in this planned retail project of US$80 million in five years. Our plan is to use this retail business to allow us to connect to the end consumers and promote our branded portfolio of luxury stones. In time, as we will be the first to understand and implement this strategy in the stone business, we can be the trusted stone brand in the consumer's mind.

Competitive Advantage: The company controls the supply of the product through its quarrying operations. Managing product distribution from quarry to end consumers will give the company the first of its many edges by competitive prices and providing consistent quality.

More importantly, a proven management team of seasoned industry experts with over 100 years of experience between them runs the company. Since the early days, this team has delivered nearly 12 times its original investments through proving up to 1.6 million tons of marble on just the first five of the 100 acres owned by the company. Furthermore, its management has established a network of distributors with hundreds of dedicated sales personnel. Such methods result in a doubling of sales each year between 1996 and 1999.

In terms of innovation, the company has developed products in the past with special backings and surfacing for use on yachts and elevators. Dynamically innovative, the company already utilizes the most advanced stone engineering techniques in its tile plant to process marble tiles from small blocks of exotic stone.

In terms of fulfillment, quality control, and service, the company has already perfected the complex logistics of fulfillment through its proprietary quality control operations. In its planned retail business, we can achieve a turn-around time of 10 days for our custom counter tops from template to installation. Finally, coating technologies to enhance durability and simplify maintenance are fully integrated into the company's products.

Market Entry: In the United States, the company' dimensional stone products are sold through 20 of the most prestigious regional distributors. They have an average of more than 400 active retail customers, and together they reach a retail segment of 4,100 retail stores. Vomarth has product leverage and an operational familiarity with these distributors. The venerable list includes Big Apple Granite & Marble (New York) and Kipper Johnson (West and East Coast).

The company's product is also sold through a large international Italian distributor, who promotes Vomarth at international trade shows. Being actively promoted with such a distinguished company puts the company's marble in front of a wide and diverse group of regional distributors, major contractors, and prominent architects and interior designers. With a little targeted marketing, the company is achieving its aim in reaching these professionals. It is the intention to use the present distribution channels to sell our portfolio of branded marble and granite.

Finally, because of its retail acquisition strategy in the United States, the economies of purchasing and distribution will allow the company to give their clients better value to the end consumer, which will greatly increase its field of prospects.

Value to Purchaser: The appearance of exotic marble creates a memorable impression of elegance that architects and interior decorators seek for their best clients. Lifestyle choices, fashion trends, and the growing cultural trend of "bringing nature inside" have caught on with Baby Boomers. The kitchen and bathroom are now areas in the home that receive the most attention, and as it happens it is where the use of natural materials like stone can make all the difference. Since 80 percent of the housing stock in the States was built before 1980, this leaves a huge market for our products in the remodeling sector.

Strong and durable, stones in foyers, kitchens, fireplace surrounds, and bathrooms are all strong selling points for any building or home that is on the market. In our increasingly health-conscious world, polished stone surfaces is one of the purest environments for those who suffer from dust and other allergies.

THE COMPANY: HISTORICAL BRIEF

Dating from the Pre-Cambrian period over 750 million years ago, Vomarth marble shows twisted and interlocking bands of serpentine in varying shades of sepia, cream, green, blue, red, brown, and gray interrupted by veins of crystalline calcite and dolomite.

Noted for its wide variety of colorful shades, Vomarth's marble is sometimes used as a semi-precious stone and is preferred by famous sculptors to create national monuments and treasured pieces of art, notable architects and designers have also taken advantage of its rare beauty to add elegance and prestige to their buildings. In fact, many publications around the globe have said our marble may be "the world's most beautiful stone."

Sawn marble—along with granite, limestone, slate, and other semi-precious stones—constitutes the dimensional stone industry. The dimensional stone industry is a US$60 billion-per-year world market with thousands of quarries supplying stone and thousands of commercial fabricators serving the end-user.

Vomarth was founded by Ed Danesi and his daughter Bonnie Slinger. The Danesi family has traditionally been in the marble business and has contributed their quarries as their investment in Vomarth. The quarries include the Kolpart and Loperizo leases and lands of 100 acres, which are in the main marble area in the geological area known as the "Vomarth Marble Formation" north of Rome. Just the first eight of the 100 acres have proven reserved of 3.2 million tons of marble, estimated by independent geologists and verified by accountants Arthur Anderson at a very conservative US$65 million and by some experts to be as high as US$140 million.

Along with a grant aid of US$415,000 from an Italian government agency and US$4.5 million of private equity financing (1996), Vomarth Marble Quarry (Vomarth) was formed with the objective of utilizing new technology to produce and market commercial-grade blocks, slabs, and tiles from the company's own marble reserves of exotic Italian marble.

The first several years were spent developing the quarry, building the tile plant, and selecting and installing state-of-the-art machinery and equipment. Currently, it is the most advanced quarrying and fabrication company in Ireland and has all the necessary equipment to produce marble blocks suitable for the construction industry that as recent as five years earlier, were only suitable for small giftware pieces.

Since the initial foundational stage, the company has experienced steady growth. It is now a regular exhibitor at every major stone trade show in the world where its products easily and consistently sell out. As a result, Vomarth products are delivered to no less than 20 major regional distributors, together reaching over 4,100 retail stores. Sales revenue has doubled each year between 1996 and 1999. This is a result of the company forming strategic alliances with dominant companies in the industry located in Italy and Ireland.

As a result of these successes and a seasoned managerial team with a proven track record in place, the company now feels comfortable to seek financing to implement its retail acquisition strategy.

THE OPPORTUNITY

Vomarth has identified an opportunity in the dimensional stone business that it is uniquely qualified to capitalize on. Since Vomarth has a presence across the supply chain through its primary marble extraction business and its wholesale distribution of that marble, the company now intends to add the final element—retailing. Implementation of this element strengthens opportunities in each of the three areas to create an extremely competitive stone business.

Apart from the large growing market in the existing stone business, we believe that a whole new customer will enter the market as the effects of the increasing volume of business drive down the costs of stone. Like Henry Ford and his low cost motor car which made transport suddenly available for the ordinary man, so too will the reduction in the costs of slab granite coming from South America and China create a whole new market.

The world market for dimensional natural stone at the retail level is valued at US$60 billion a year and is growing at the rate of approximately 20 percent per year, according to Jeffrey Matthews in his report "Marble & Limestone Market Study."

This report estimates the market in the United States for dimensional natural stone at US$5 billion, and 80 percent of this is imported. Floor Covering Weekly estimates the retail floor covering market alone at US$40.8 billion per year. End-users of natural stone products are divided between commercial and residential. Large commercial construction consists of jobs in excess of US$100,000, while large residential construction consists of jobs in excess of US$15,000. A typical residential customer spends from US$2,000 to US$5,000 for stonework per kitchen and a similar amount per bathroom.

As this is the fastest growing segment of the market, with natural stone increasingly taking market share from ceramic tiles and other artificial products, this means that every new construction site or existing commercial building or residence with floors, walls, bathrooms, a staircase, or a kitchen is a potential customer for natural stone products.

This is a tremendous market opportunity when one considers that residential construction happens to be the most profitable segment of the natural stone industry and favored by demographical factors. Namely, the "Baby Boomer" generation has come of age, and this 35-53 age group, estimated at 80 million, is now the largest spending demographic in the United States. As consumers they have come to expect and demand the most for their money, and an investment in natural stone yields the best possible value.

We see a lot of opportunity for which we are uniquely qualified to exploit, such as:

- Changing an old system of distribution that sometimes has to go through "10 different hands" from the time the stone leaves the ground until it is installed in the kitchen. There is a better way.

- The current traditional closed shop in the stone business is at last opening up because of the ubiquitous Internet and the full information today's consumer now has available to them. In effect, consumers can identify marble from a small village in Ireland and tell their stone shop all about it.

- We believe we can own the space in the consumers mind when it comes to identifying marble and granite, as there is no well-known stone brand today.

- Strategic alliances with powerful complementary businesses is already part of this company, and we intend to continue this in our retail stores.

- Our European ethos can be advantageous to our retail stores that have proven to be a compelling attraction for consumers of other European luxury products.

- Since this is an industry that traditionally spends nothing on advertising, there is an enormous first-mover advantage for any stone company that advertises and more importantly, to initiate a public relations program that creates some excitement.

- The stone industry's highly fragmented entities make it a perfect candidate for consolidation. There is a growing tension between regional distributors and their stone retailers. This has begun to change business relationships. We are seeing that as some retailers get larger, they are bypassing their regional distributor, and in turn distributors are directly bidding on retail jobs.

- The accelerated growth generated by the acquisitions of retail fabricators will provide currency for more acquisitions, creating a snowball effect. In essence, the opportunity here is the creation of a "category-killer," the first of its kind that consolidates the dimensional stone industry. Vomarth is this company.

By owning and controlling the stone at its source and marketing these brands through company-owned retail showrooms, the company retains market initiative to ensure delivering of consistently high-quality products at truly competitive prices from source to finish.

THE STRATEGY

Vomarth Marble Quarry will achieve US$600 million in annual sales of its natural stone products, with a short-term goal of US$80 million in five years. We will accomplish this goal through a two-prong strategy: that of introducing a portfolio of branded marble and granite products including the world-famous Vomarth and secondly, by the acquisition of 18 stone retail/fabrication centers across the United States, and by doing so consolidate a fragmented, and resource-poor industry.

According to the branding part of its strategy, Vomarth will develop its Vomarth brand into a portfolio of stones trusted to be the highest quality in the dimensional stone industry. Besides its own Italian Vomarth Aqua, that is already recognized as the leading luxury marble in the world, Vomarth will brand granite and other exotic and neutral field-type marbles and process them with its proprietary surfacing techniques. The company intends to align with other quarries that are the sources of other stones in order to brand and organize their distribution.

By controlling the stone at its source and marketing these brands through company-owned retail showrooms, the company can establish a well-known brand in the stone industry for the first time. Furthermore, through its investments and experience in technology, the company has also developed new uses for stone such as lightweight stone panels that can be used where heavier format stone would be prohibitive.

The key to implementing our branding strategy is retail; the company's acquisition team will identify and qualify several stone retail/fabricators that will have a proven track record of profitable sales and will be the dominant (or have the possibility to be the dominant) stone business in their market area.

Within the first few years, Vomarth plans to achieve US$30 million in sales by using the established sales organizations of the acquired retail stone fabricators. Much of the sales and projects in these acquired businesses are organized through personal contacts with the endusers. Knowing what these customers expect and value is essential to delivering a product that will please them. Personnel and stonemasons at the acquired businesses will be retrained to communicate the value of Vomarth's products and services to the customers, and to deliver that value by way of quality products and services on a consistent basis.

The company will strive to become recognized as the foremost expert in natural stone fabrication and installation. This will allow Vomarth to promote its own brands and create more business for its portfolio of stone brands through its distribution network.

The stream of Vomarth natural stone products will increase quickly with each profitable acquisition, supported by targeted advertising and promotions of the expanding network of retail centers. The brands will become recognized and trusted for quality and value. Sales figures will further increase.

With increased economies of purchasing, streamlined distribution, and professionally managed retailers, the company seeks to increase net margins in the acquired businesses from the current 12.5 percent to 20 percent within one year of takeover. In addition, as most sales require a deposit, the call on the company's cash resources will be limited.

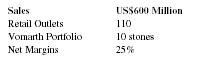

Over time, the company expects to meet or exceed the following objectives:

| Sales | US$600 Million |

| Retail Outlets | 110 |

| Vomarth Portfolio | 10 stones |

| Net Margins | 25% |

In purchasing of retail stores, Vomarth regards the change of ownership to be a traumatic and sensitive issue and so will develop a plan to ensure that the introduction of the acquired retail outlets be achieved with the least possible interruption to these businesses. In addition, Vomarth recognizes that the fair treatment of employees in a dynamic environment is critical to the success of the plan.

Regional distributors in major areas across the United States will stock sufficient quantities of Vomarth stone products so that a full range of product will be within driving distance of 80 percent of the U.S. population. In the meantime, Vomarth will continue with its development of the quarry and manufacturing plant. New advances in technology and equipment will be introduced which will enable the company to offer additional products and increase the uses of its existing products. This emphasis on sales of the company's own branded products at the retail end will have a major effect on the quarry's profitability.

The company intends to use the Internet to educate and generate customers for its stores, and so will provide a localized source for a nationally promoted product.

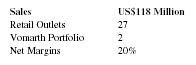

Within five years the company expects to meet or exceed the following short-term objectives:

| Sales | US$118 Million |

| Retail Outlets | 27 |

| Vomarth Portfolio | 2 |

| Net Margins | 20% |

This dynamic growth opportunity for Vomarth is within its grasp because the experience and vision of its key people, who have grown up in the stone business, are proven innovators in the business and have kept up with the industry's cutting-edge technology.

The company maintains a clear conception of its market niche and its competitive advantage. Vomarth keeps itself positioned to capitalize on every situation that will create opportunity and value within the area of the company's core competencies. Last but not least, Vomarth is implementing systems to ensure that the company can consistently deliver both products and service as offered by defining what constitutes real value to the customer and by setting a higher standard than the competition in both manufacturing and in over-the-top service.

STRATEGY SNAPSHOT

Action Steps:

- Vomarth acquires retail shops with a proven track record of profitability to generate strong business cash flow.

- The retail shops allow Vomarth to connect to the end consumer and market its Vomarth and other branded products directly to the public.

- The company will then use its raw material extraction alliances to extend and expand its portfolio of stone brands.

- Targeted marketing at this point will enable Vomarth to become the dominant stone brand in the world, potentially having a global market share as high as 40 percent.

Ensuring correct installation and maintenance procedures will provide long-term immunity from competitors that compromise on this element of the process for short-term gain.

MARKETING STRATEGY

The company's promotional strategy relies heavily on communicating the value of its products and services to the customer. The company will market by directly interfacing with the end-users, architects, and designers through consistent advertising in selected publications. Advertisements promoting Vomarth products have already run in upscale magazines such as Architectural Digest, House Beautiful, Florida Design, Southern Living, and Southern Accents. In addition, the company's showrooms will feature several striking floor designs.

The coverage the company receives in marble trade magazines and in prestigious publications such as Hibernia Magazine enhances its public image. Vomarth will utilize both a "push" strategy and a "pull" strategy in promoting its products. It will maximize its considerable channels of distribution to push the offering to the market.

Currently, the company's dimensional stone products are sold through 20 of the most prestigious regional distributors in the United States. Each has an average of 400 active customers, and combined they reach a retail segment of 4,100 shops. Vomarth will continue to maintain and develop these important relationships.

In addition to the United States, distributors in Italy, Ireland, the United Kingdom, France, and Germany are preparing to promote the company's product line. Later this year regional distributors will be set up in Portugal, Spain, Mexico, and Argentina when more products become available.

The company further intends to begin aggressively promoting its brands of natural stone products directly to the end consumer when it has its own retail stores in the United States. Our showrooms and the showrooms of the regional distributors, in addition to the company's displays at trade shows, will likewise increase consumer awareness of the company's products. As consumer demand develops for the company's brands, the "pull" strategy will begin to take effect throughout the supply chain. With the help of a sophisticated website, Vomarth can use the Internet to create awareness and pull in consumers.

MARKET & PRODUCT ANALYSIS

The world market for dimensional natural stone at the retail level is valued at US$60 billion. The overall U.S. floor covering market is estimated at US$40.8 billion per year. There are currently very few domestic producers of marble tile, and the variety of their stone is quite limited.

Critic Charles H. Caffin (1903) enthused, "No description can give an adequate idea of its stateliness, the exquisite mystery of graded greens and grays black, their tempestuous streaking and tender veining and the perfect texture of their polished surface. The most heedless visitor cannot pass them un-admired [for] the connoisseur will be enthusiastic."

The company fills a demand for luxury stones fabricated to exact specifications. Vomarth communicates regularly with regional distributors, local fabricators and architects, designers and end-users to identify their needs and consistently deliver a quality product and service unavailable elsewhere.

The company's marble products offer an attractive value to buyers who desire a high-quality exclusive product. The appearance of exotic marble creates a memorable impression of elegance that architects and interior decorators designers seek for their best clients. Fashion trends, lifestyle choices, and the current economic growth period in the United States all contribute to the increased use of natural stone and today's growing cultural trend of "bringing nature inside"; of creating a more natural, more relaxed (though still sophisticated) space in which to live and grow.

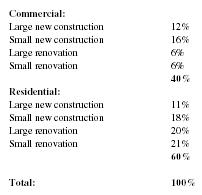

End users of natural stone products are divided between commercial and residential. Large commercial construction consists of jobs in excess of US$100,000; large residential construction consists of jobs in excess of US$15,000.

The major market segments for the company's natural stone products are as follows:

| Commercial: | |

| Large new construction | 12% |

| Small new construction | 16% |

| Large renovation | 6% |

| Small renovation | 6% |

| 40% | |

| Residential: | |

| Large new construction | 11% |

| Small new construction | 18% |

| Large renovation | 20% |

| Small renovation | 21% |

| 60% | |

| Total: | 100% |

The company will market its own portfolio of branded stones through the regional distributors, retail home improvement centers, and stone retail/fabrication businesses.

Having our own retail stores will make it possible for prospective buyers to connect with the actual quarry owners, which is unusual in the retail sector of the stone industry. This direct connection between raw material producer and end-user is one of the unique pluses we will bring to our customers.

The use of natural stone is increasing in use in the U.S. with the bulk of the market located in just five geographic areas: New York, Florida, Illinois, California, and Texas. Throughout the United States and Europe marble and other natural stones have traditionally been used on the most prestigious commercial and residential projects. All developed regions of the globe are markets for natural stone tiles and slabs.

Renovators will see an immediate transformation by replacing existing materials with Vomarth natural stone in foyers, kitchens, fireplace surrounds, and baths. In effect, every new construction site or existing commercial building or residence with floors, walls, bathrooms, a staircase, or a kitchen is a potential customer for Vomarth natural stone products. These are also strong selling points for any building or home that is on the market.

Architects and interior decorators/designers will benefit from introducing a client to a special product. A satisfied client often translates to another assignment. Architects need the materials they specify to make a positive aesthetic statement while at the same time offering ease of installation, durability, reliability, uniformity, and ease of maintenance. They will specify a material that has these qualities, and Vomarth consistently meet these demands.

Both residential and commercial building owners are increasingly choosing natural stone over synthetic hard coverings because of its natural beauty and durability. In the United States, since 80 percent of residential housing was built before 1980, the renovations market has created further demand for Vomarth products.

In addition, our increasingly health-conscious world supports bringing nature inside to create a more relaxed and positive living environment. Polished stone flooring is one of the purest environments for those who suffer from dust and other allergies, with a bonus of low maintenance.

Vomarth's branded Vomarth products possess superior strength and durability and can be installed by any trained stonemason. The company uses the most innovative stone engineering to produce its tiles and slabs. Vomarth manufactures exotic marble three-eighths inch and three-quarter inch tiles and slabs. Italian Vomarth Blue is a translucent aqua-green color mixed with variegation of dark and pale shades of blue. This stone makes a striking impression in the following formats:

- Vomarth marble slabs: 8′ x 4′ slabs used by marble fabricators for counter tops, vanity tops, and worktops

- Vomarth marble tiles: 12" x 12" and larger polished square tiles used in the floor and wall covering business

- Vomarth panels: 7mm panel slabs, thin, lightweight and extremely strong panels for specialty requirements such as elevators or aircraft

- Other: Vanity units, table tops, fireplace surrounds, and columns

The company will develop and expand its portfolio of branded luxury stones to include a selection of both exotic and neutral field-type marbles.

The company's tile plant in Italy has recently begun to make many of its specialty Aqua and Cream tiles directly blocks, and it is the only plant in the world with the equipment capable of processing these difficult-to-work luxury stones into tile.

Vomarth will offer luxury stones and engineered stone products unavailable anywhere else. In addition, Vomarth will continue to develop and sell products with special backings and surfacing for use on unique projects such as yachts and elevators. It will also utilize the most advanced stone engineering techniques to facilitate special effects such as book matching and quarter book matching, that attract high-end prospects to the company's products.

All of these stones will be processed through the company's stone engineering and surface techniques to meet the demands of architects and builders. Vomarth has access to technology including the development of a coating substance that when applied makes the marble scratchproof, graffiti proof, and easier to clean and maintain. A quick buffing by the regular maintenance person restores the finish to its original luster. Such advanced stone engineering is a key element of the Vomarth brand name.

Should there be any need for expert consultation, the company's factory, sales office, and showroom in Recess, Ireland are staffed to provide expert advice on any questions relating to maintenance or repairs. The regional distributors who handle Vomarth stone products are also fully capable of performing installation and repairs if tiles should need replacement. The company stands ready to take back any of its products that are flawed in any way and guarantees customer satisfaction. To date, the quality control in the factory has been effective and the company has never had to take any product back.

Vomarth is presenting the market with two main offerings:

- The company will offer stone distributors a nationally promoted stone brand that is the recognized standard in the industry and also the best value. With the exclusive Irish Vomarth as the foundation, we will add granite and other marble, both exotic and neutral field-type stones, to broaden the portfolio.

- Vomarth will offer consumers the ultimate stone-buying experience through our own retail showrooms and provide the most professional selection, fabrication, and installation on the market. We will brand the totality of that purchasing experience and not just our natural stone products alone.

The beauty, strength, and endurance of natural stone make it the covering of choice in both new and renovation construction. It is little wonder that currently, the natural stone industry continues to expand at rates exceeding 20 percent per year.

COMPETITIVE ANALYSIS

The company has already shown its ability to compete in its existing quarrying business. From a standing start just over three years ago, its products are now available throughout the United States. No other company in this industry has achieved such market penetration so fast.

By acquiring their own stone retailers, Vomarth can further increase sales of Vomarth. The Vomarth plan has four major competitive advantages over the existing stone retailers:

- With seven retail units in one geographic region, Vomarth can purchase slab and tile in container loads, which is economically efficient. Apart from the cost savings this represents, it means that we can always select the best quality stones direct from the quarries for our customers.

- Seven retail units in one area also facilitate the operation of a central, highly automated fabrication workshop. Apart from providing a consistent level of quality, it will also allow us to deliver customized products such as granite counter tops within 10 days. Such a rate of turnaround is a first in the industry and currently not available in the market.

- Our retail showrooms will have designers who are also salespeople, and they will work in teams both in the retail showrooms and outside sales. This is novel in an industry that traditionally has not made full use of a professional, dedicated sales force.

- Installation: We regard this as the critical element in our whole plan. Installation is the point where the customers have the most connection to the product and the retailer and as well where the retailer has the most opportunity to make a positive impact on the customer. We intend to be the best installers in our market area.

Vomarth has identified five well-run companies in the retailing of stone that represents the typical competitors we will have:

- Renaissance Stones (Miami, Florida)

- K. Neopolitan (Washington, D.C.)

- Masterpiece Stones (Dallas, Texas)

- The Stone House (Orlando, Florida)

- Hill's Granite & Marble (San Francisco, California)

The following is an analysis of the competitive strengths and weaknesses of each.

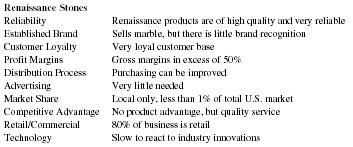

| Renaissance Stones | |

| Reliability | Renaissance products are of high quality and very reliable |

| Established Brand | Sells marble, but there is little brand recognition |

| Customer Loyalty | Very loyal customer base |

| Profit Margins | Gross margins in excess of 50% |

| Distribution Process | Purchasing can be improved |

| Advertising | Very little needed |

| Market Share | Local only, less than 1% of total U.S. market |

| Competitive Advantage | No product advantage, but quality service |

| Retail/Commercial | 80% of business is retail |

| Technology | Slow to react to industry innovations |

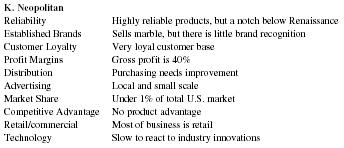

| K. Neopolitan | |

| Reliability | Highly reliable products, but a notch below Renaissance |

| Established Brands | Sells marble, but there is little brand recognition |

| Customer Loyalty | Very loyal customer base |

| Profit Margins | Gross profit is 40% |

| Distribution | Purchasing needs improvement |

| Advertising | Local and small scale |

| Market Share | Under 1% of total U.S. market |

| Competitive Advantage | No product advantage |

| Retail/commercial | Most of business is retail |

| Technology | Slow to react to industry innovations |

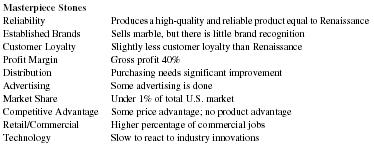

| Masterpiece Stones | |

| Reliability | Produces a high-quality and reliable product equal to Renaissance |

| Established Brands | Sells marble, but there is little brand recognition |

| Customer Loyalty | Slightly less customer loyalty than Renaissance |

| Profit Margin | Gross profit 40% |

| Distribution | Purchasing needs significant improvement |

| Advertising | Some advertising is done |

| Market Share | Under 1% of total U.S. market |

| Competitive Advantage | Some price advantage; no product advantage |

| Retail/Commercial | Higher percentage of commercial jobs |

| Technology | Slow to react to industry innovations |

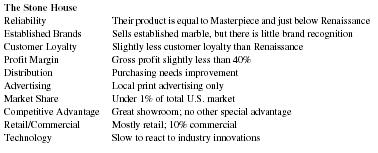

| The Stone House | |

| Reliability | Their product is equal to Masterpiece and just below Renaissance |

| Established Brands | Sells established marble, but there is little brand recognition |

| Customer Loyalty | Slightly less customer loyalty than Renaissance |

| Profit Margin | Gross profit slightly less than 40% |

| Distribution | Purchasing needs improvement |

| Advertising | Local print advertising only |

| Market Share | Under 1% of total U.S. market |

| Competitive Advantage | Great showroom; no other special advantage |

| Retail/Commercial | Mostly retail; 10% commercial |

| Technology | Slow to react to industry innovations |

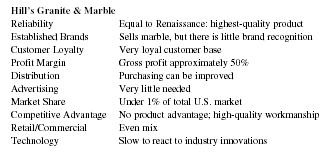

| Hill's Granite & Marble | |

| Reliability | Equal to Renaissance: highest-quality product |

| Established Brands | Sells marble, but there is little brand recognition |

| Customer Loyalty | Very loyal customer base |

| Profit Margin | Gross profit approximately 50% |

| Distribution | Purchasing can be improved |

| Advertising | Very little needed |

| Market Share | Under 1% of total U.S. market |

| Competitive Advantage | No product advantage; high-quality workmanship |

| Retail/Commercial | Even mix |

| Technology | Slow to react to industry innovations |

EXECUTIVE MANAGEMENT

Ed Danesi, age 64, is Chairman of the Board and CEO. Danesi is an Italian national and has been actively involved in marble for the last 42 years from quarrying to production and from fabrication to retail sales. He spends most of his time meeting with potential customers and developing new markets. He began his career in the marble business at age 22 when he began managing a marble processing plant. Ed has quarried Vomarth, processed the stone, and sold finished products from his marble shop near Rome. Recently he set up regional and international distributors for Vomarth in every section of the United States.

Bonnie Slinger, 36, is the CFO and COO. She holds an Honors Bachelor of Commerce degree from University College Rome and worked at the accounting firm of Smallton Douglas in London for two years prior to joining the company in 1994. Since March of that year Bonnie has held the position of Managing Director of Ed Danesi Marble Ltd., a subsidiary of Vomarth and a company she founded and owned. Bonnie directed the development of the quarry and the purchase and commissioning of the tile manufacturing plant. She also set up the company's office systems, including the MIS and accounting systems.

Chuck Wilson, 43, is the Quarrymaster. Chuck has been involved in the Vomarth business all of his life. His family was associated with the Italian White Marble Company and the Quest Black Marble quarries near Rome. He managed both marble quarries and factories at different times in his career. He commissioned a marble manufacturing plant in Texas in the early 1990s and trained the entire staff on the proper working of marble fabrication. Chuck is a master at quarry management and has increased production from 480 tons in 1995 to 6,000 tons in 1999.

Nicholas Kitt, 36, is the Production Manager. Before joining Vomarth, Nicholas managed a large manufacturing company with 10 locations in Europe and Asia. After continuing his education by completing management courses in both England and France, Nicholas was put in charge of production and logistics for all 10 of that company's facilities. He built and established Vomarth's marble manufacturing plant in Rome and has taken the plant from zero production to producing 7,400 square feet per month. He is responsible for delivering the finished product to customers.

FINANCIAL SUMMARY

The company is seeking US$12 million in a second round of outside investment to fund acquisitions, operations, marketing/sales, and personnel growth. Vomarth is expected to generate the majority of its revenue through:

- Sales of natural stone products in its retail showrooms

- Sales of Vomarth-branded marble and granite

- Consultation services to professionals

The company currently has assets worth US$65 million.

The following is a summary of the company's financial projections:

| Projections | |||||

| Financials (millions) | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

| Sales Revenue | 4.22 | 15.80 | 30.34 | 61.82 | 118.47 |

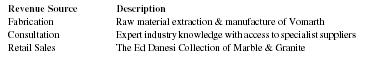

Revenue Model

The company will generate the following revenue streams, with a specific focus on transitioning the business from its historical emphasis on fabrication and quarrying operation to retail and consulting revenue incurred through its retail stores.

| Revenue Source | Description |

| Fabrication | Raw material extraction & manufacture of Vomarth |

| Consultation | Expert industry knowledge with access to specialist suppliers |

| Retail Sales | The Ed Danesi Collection of Marble & Granite |

Exit Strategies

Vomarth is an attractive IPO option given the company's following successes:

- Notable revenue flows

- Leveraged production, distribution, and dedicated sales team

- Selling into a fast-growing market

- Large, versatile, and growing client base