Skin Cream Formulator

BUSINESS PLAN LABELLE INDUSTRIES, INC.

4515 Mapletree Boulevard

Grand Rapids, Michigan 49503

LaBelle is a niche player in the specialty skincare business, focusing on value-added products which are not widely or readily available in the United States. We have perfected unique distribution processes resulting in lower distributing costs and high profitability. We have established a network of strategic alliances with a manufacturer who has the capability to ascend from laboratory to commercial scale and manufacture products in accordance with quality specifications.

- EXECUTIVE SUMMARY

- COMPANY SUMMARY

- PRODUCTS/INGREDIENTS

- MARKET ANALYSIS SUMMARY

- STRATEGY & IMPLEMENTATION SUMMARY

- MANAGEMENT SUMMARY

- FINANCIAL PLAN

- APPENDIX

EXECUTIVE SUMMARY

LaBelle Industries, Inc. (LaBelle) is a home-based specialty skin cream formulator, wholesaler and distributor. We sell products to companies ranging from drugstores to consumers. This business is owned and operated by principal investor Roman Miller. He is a strong knowledge-based manager, with a combined 25 years of experience in this industry. LaBelle was created in 2001 and is currently located in Roman's home in Grand Rapids, Michigan. The purpose of the business being home-based is to lower the costs of overhead.

Through Reuben Retro Skincare, we manufacture and distribute an approved skin cream used to improve arthritis in muscle mass. LaBelle also produces one other specialty formula that will be detailed later in this document.

In theory, a wholesale distributor behaves no differently from a retailer: it purchases goods it intends to sell at a profit. The fundamental difference between the two is that retailers sell to the buying public or "the consumer" and distributors sell to retail businesses and fellow wholesale firms. In the strict sense of the term, distributors never sell to the public consumer, although the advent of wholesale membership clubs and other "power retailers" has begun to call that definition into question.

A new, natural product called Nopeinne, conceived by Roman Miller, will soon be available to relieve physical pain and suffering of mankind. An investment into Nopeinne is an adventure into the near future. Nopeinne is a manifestation of remedies used for treatment of wounds and physical disorder that caused pain and suffering among a nomadic people, namely the American Indian, before the settling of the pilgrims in 1620.

LaBelle is a niche player in the specialty skincare business, focusing on value-added products which are not widely or readily available in the United States. We have perfected unique distribution processes resulting in lower distributing costs and high profitability. We have established a network of strategic alliances with a manufacturer who has the capability to ascend from laboratory to commercial scale and manufacture products in accordance with quality specifications.

Our retailers and our customers have given us an opportunity to provide products beyond our present capability. We need to increase our inventory, purchase advertising, and establish marketing and support activities.

Funding Requirements

The total amount needed for this start-up business is $38,178. Roman Miller has invested $7,636 into this business and is seeking a commercial loan of $30,542 to enable us to expand our operation and become a major factor in the production and distribution of skincare products. The funds will be distributed in the following way: $10,000 for research and development of the products, $25,000 for actual production of the product, $2,178 for radio promotions, and $1,000 for television promotions.

Our signature product Nopeinne is manufactured in cream form. We are the only company in the world capable of manufacturing this product using our patented cream formula. Our market research shows that the demand for this product alone justifies the future expansion of our facilities from being home-based to brick and mortar in 2005.

Objectives

Our objectives are to have:

- a gross margin of 65 percent or more

- a net profit above 10 percent of sale

- sales passing the projected sales of $252,000 by the year 2004

Mission

We see our mission as not only that of wholesale-distributor, but a trade supplier where we can reach the end-user market with products we consider to be proprietary. We seek a fair and responsible profit, enough to keep the company financially healthy for the long term and to satisfactorily compensate owners and investors for their money and risk.

Keys to Success

The keys to success in this business are:

- Marketing: either dealing with channel problems and barriers to entry, or solving problems with major advertising and promotion budgets.

- Management: products delivered on time, cost controlled, marketing budgets managed.

- Uncompromising commitment to the quality of the end product: multiple skin cream products.

- Successful niche marketing: we need to find the quality-conscious customer in the right channels, and we need to make sure that customer can find us.

- Almost-automatic development and distribution of our product to maintain high demand needs.

COMPANY SUMMARY

LaBelle Industries Inc., is a privately owned specialty formulator of skin creams and ointments. Our end-users are in all levels of skincare needs ranging from acne to razor bumps to arthritis.

Company Ownership

LaBelle is a corporation established in 2001. The company is owned by Roman Miller.

Daily Operations

The hours of business will be from 8:00 A.M. until 5:00 P.M., Monday through Saturday, and closed on all major holidays. Because our business is home-based, it is possible we may work overtime by answering the telephone after 5:00 P.M. or before 8:00 A.M. Any person-to-person contact will be done at the customer's establishment.

We will perform most of these functions on a daily basis:

- Checking invoices against payments.

- Purchasing inventory.

- Visiting customers for promotion and service evaluation.

- Scheduling deliveries (including immediate deliveries when shortages occur) and monitoring their progress.

- Fielding calls from our manufacturer and retailers.

- Order processing.

- Inventory control.

We will perform these activities on a weekly/monthly basis:

- Maintain our bookkeeping and recordkeeping to ensure our distribution business's cash flow in the short run and avoid confusion at the end of the fiscal year.

We will keep a tight reign on these daily/weekly/monthly duties to improve our business's efficiency and reduce operating problems during the week.

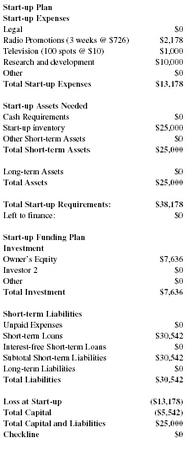

Start-up Summary

The total amount needed for this start-up business is $38,178. Roman Miller has invested $7,636 into this business and is seeking a commercial loan of $30,542 to enable us to expand our operation and become a major factor in the production and distribution of skincare products. The funds will be distributed in the following way: $10,000 for research and development of the products, $25,000 for actual production of the product, $2,178 for radio promotions, and $1,000 for television promotions.

| Start-up Plan | |

| Start-up Expenses | |

| Legal | $0 |

| Radio Promotions (3 weeks @ $726) | $2,178 |

| Television (100 spots @ $10) | $1,000 |

| Research and development | $10,000 |

| Other | $0 |

| Total Start-up Expenses | $13,178 |

| Start-up Assets Needed | |

| Cash Requirements | $0 |

| Start-up inventory | $25,000 |

| Other Short-term Assets | $0 |

| Total Short-term Assets | $25,000 |

| Long-term Assets | $0 |

| Total Assets | $25,000 |

| Total Start-up Requirements: | $38,178 |

| Left to finance: | $0 |

| Start-up Funding Plan | |

| Investment | |

| Owner's Equity | $7,636 |

| Investor 2 | $0 |

| Other | $0 |

| Total Investment | $7,636 |

| Short-term Liabilities | |

| Unpaid Expenses | $0 |

| Short-term Loans | $30,542 |

| Interest-free Short-term Loans | $0 |

| Subtotal Short-term Liabilities | $30,542 |

| Long-term Liabilities | $0 |

| Total Liabilities | $30,542 |

| Loss at Start-up | ($13,178) |

| Total Capital | ($5,542) |

| Total Capital and Liabilities | $25,000 |

| Checkline | $0 |

Company Locations and Facilities

LaBelle Industries, Inc. is a home-based business located at 4515 Mapletree Boulevard, Grand Rapids, Michigan 49503. Our present office is small but is in a room of its own to keep our home and work lives separate. Our office contains bookshelves, file cabinet, desk with computer, sitting chairs, a fax, a copier, and space for inventory storage area for additional small products.

We will use restaurants, hotel lobbies, and conference rooms if our home won't accommodate clients comfortably. Also, as we add employees, we will look at taking on additional space or finding a new location. All products will be formulated, packaged, and shipped to the distributors through the Reuben Retro Skincare Company or hand-delivered by the LaBelle manager. This way we cut down on storage space, overstocked inventory, and any other cost surrounding the manufacturing aspect of our business.

PRODUCTS/INGREDIENTS

Our products are skincare creams for acne and razor bumps and medicated therapy in the form of an arthritis cream. The products are all natural with no chemicals. The products also include herbs.

Herbs were used extensively by ancient Romans and Egyptians and are frequently found in the tombs of Pharoahs by archaeologists. Native Americans made use of herbs and their medicineman shared their herbal remedies with less fortunate African Americans who did not have access to a physician or modern medical treatment for physical disorder, pain, and/or injury.

African Americans, during that era, depended exclusively on treatment by midwives among them when incapacitated or physically disabled on a temporary basis. They harvested assorted herbs during the growing season which were then dried by the sun and the wind and even in the shelters of Indians and slaves. Many such wild plants have been used successfully for decades by chefs and cooks at public eating establishments for the purpose of enhancing the flavor of food.

Modern supermarkets stock a complete assortment of familiar herbs, attributed to popular domestic demand. Nopeinne is the creation of an aware male amateur cook who began experimenting with herbs and fruits, based on his knowledge of natural medicinal properties contained in them. Among them are sassafras, sena, and the aloe vera plant, found among plants in many homes and used to treat minor burns. Herb tea is a popular beverage consumed by millions of people around the world. Peppermint, eucalyptus, lemon balm, lavender, compry, Queen Anne's Lace, capsicum, feverfew, ginseng, echinacea, and hot pepper are a few herbs that contain healing properties. Other valuable foods used for medicinal purposes are citrus fruits, bananas, and oranges and are included in fabricating this formula. The extensive use of herbs has been well established by man, including the source of many drugs, although Nopeinne does not contain harmful foreign properties.

Product Description

Our current and future products consist of the following:

Skincare—facial treatments

Body and Bath—bath and shower products that are not extensions of a fine fragrance

Men's Products—men's hair bump treatment

Other products—medicated therapy cream for arthritis

Other—new products that don't fit the above categories

A new, natural product called Nopeinne, conceived by a man of vision, will soon be available to relieve physical pain and suffering of mankind. An investment into Nopeinne is an adventure into the near future. Nopeinne is a manifestation of remedies used for treatment of wounds and physical disorder that caused pain and suffering among a nomadic people, namely the American Indian, before the settling of the pilgrims in 1620.

Nopeinne is not expected to accomplish what Viagra did for men, but its purpose is to improve people's physical ability to function. This new product may be the key that will unlock stiff joints and tight muscles while raising the investors' monetary value.

Competitive Comparison

Within our niche we have several significant competitors: Tigerbalm, Flexall, Bengay, Heat, and Asper Cream. In general, however, our competition is not in our niche. We compete against skin cream companies that use chemicals instead of natural herb formulas. It isn't that people choose our competitors instead of our product. Instead they choose lesser quality, chemical-formed creams instead of natural herbs formulas we offer. This will change as we begin letting the public know they now have a choice of getting the same relief and better results without the chemical components. We will continue to examine our rivals' weaknesses and strengths, and continue to strategically promote our strengths and their weaknesses.

Marketing Plan

Our marketing plan consists of providing a direct line of communication regarding our product to current and prospective customers. Our advertising campaign will accomplish the following:

- Convince customers that our company's products are the best available

- Enhance our company's image

- Point out the need and create a desire for our products

- Announce new products or programs

- Draw customers to our business

Our advertisements will be simple and easily understood, truthful, informative, sincere, and customer-oriented. We will use the following advertising media for our home-based business:

- Personal contact

- Newspapers

- Magazines

- Newsletters

- Telephone directories

- Radio

- Online/Internet

- Flyers—Direct Mail

- Specialty Items (pencils, calendars, matchbooks, telephone pads, etc.)

- Sales Letters

- Brochures and Catalogs

- Postcards

- Coupon Mailers

- Radio Give-a-Ways

All of our correspondence will be professional, printed on good paper and with clean typing free of any spelling errors.

Sourcing

Our main sourcing contact will be Reuben Retro Skincare, located at 42005 West 45th Street, New York, New York.

Reuben Retro was founded in 1975 by Master Chemist Jean Fream, a graduate of the prestigious Sorbonne in Paris, France. Monsieur Fream's celebrated formulas are manufactured for industry giants such as Loreal and Maybelline.

His insight and genius forms the very core of Reuben Retro's Research and Development Team, combining the master disciplines of European craftsmanship with the latest in scientific technologies and the finest natural ingredients.

For more than two decades, Reuben Retro has developed and manufactured products that make a difference in people's lives. Thousands have discovered our products and have rediscovered beauty once compromised by problematic skin. And more have found our products to be a healthy alternative to harsh medical and pharmaceutical treatments.

For more than 20 years they have used nature as their guide and maintained a natural approach to skincare. Their mission is simple.

LaBelle intends to demystify skincare, improve the way you look, and most importantly, help you feel better about yourself.

Technology

We are a highly technical niche player with a specialized product line that is in great demand. We have developed new technology and processes that are in demand by other cosmetic manufacturers as well as by major distributors who do not have the ability to produce our specialty products. We have the management team and the skin cream formulations to become a major player in the specialized niche we serve. We also hope to develop a website in the near future.

Future Products

Our future products include:

- Bath oils

- Moisturizer

- Additional acne creams

- Shaving bump cream

MARKET ANALYSIS SUMMARY

Our target markets are the retailers who have established relationships with consumers and the consumers themselves via word-of-mouth. We are essentially the distributing arm for these retailers and can provide development services as well as products for them.

The retail businesses are in the business of selling goods, and there are more than 1.5 million of them across the country. The greater the difference between the selling price and the price they pay for the product, the greater their profit. It follows that retailers have (or should have) a keen interest in the way products move from the manufacturer to them because that's where the markup occurs. If they can find a wholesale distributor like LaBelle, who can deliver a product on their shelves at a lower price and still provide exemplary service, few will refuse the chance.

Random test results of Nopeinne exceed anticipated performance at the laboratory level while clinical analysis is pending. This new product netted an impressive percent approval from Michigan and Indiana consumers ranging in age from 13 to 50 and older over a two-year period with no report of side effects.

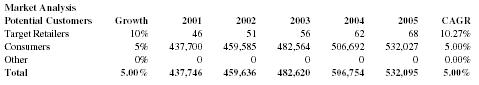

Market Segmentation

Retailers: our market research indicates about 46 potential retailers within a 1-25 mile radius of our location, who currently sell our competitors products. Our target retailers are drugstores/pharmacies.

Consumers: There are 437,700 individuals in Kent County. Of those 315,008 are adults 18 and older, which are our target consumer market.

| Market Analysis | |||||||

| Potential Customers | Growth | 2001 | 2002 | 2003 | 2004 | 2005 | CAGR |

| Target Retailers | 10% | 46 | 51 | 56 | 62 | 68 | 10.27% |

| Consumers | 5% | 437,700 | 459,585 | 482,564 | 506,692 | 532,027 | 5.00% |

| Other | 0% | 0 | 0 | 0 | 0 | 0 | 0.00% |

| Total | 5.00% | 437,746 | 459,636 | 482,620 | 506,754 | 532,095 | 5.00% |

Target Market Segment Strategy

Retail Business: Retailers are in the business of selling goods, and there are more than 1.5 million of them across the country. The greater the difference between the selling price and the price they pay for the product, the greater their profit. It follows that retailers have (or should have) a keen interest in the way products move from the manufacturer to them because that's where the markup occurs. If they can find a wholesale distributor like LaBelle, who can deliver a product on their shelves at a lower price and still provide exemplary service, few will refuse the chance. We have retailers who will be begging for our products and we anticipate having backorders, so it is only logical that we will devote most of our time meeting this demand.

Consumer Market: This is potentially our biggest market for Nopeinne; it is limited only by our ability to produce. We look at the potential in this market as the basis for our growth. We will market to this group by giving them a clear comparison between the chemical-based products they are now using and our natural products. This marketing strategy will begin by letting the public know they now have a choice of getting the same relief and better results without the chemical components followed by their conversion over to our products.

Market Needs

Many thousands of individuals are immobilized by osteoarthritis or from temporary muscle strain and do not have access to soothing hot baths or physical therapy that relieve suffering, but Nopeinne is instantly available to a victim in pain. Hundreds of thousands of mature persons agonize about debilitating aches and pain while spending as many dollars annually for various health remedies to find relief.

Repulsive blotches on the skin, ugly pimples, sore joints, and muscles unquestionably diminish individual aesthetic qualities, progress, and success, but our Nopeinne formula is the knight in shining armor, prepared to challenge and change that undesirable status. Nopeinne is not expected to accomplish what Viagra did for men, but its purpose is to improve people's physical ability to function. This new product may be the key that will unlock stiff joints and tight muscles while raising the investors' monetary value.

Among them are staggering numbers of high profile men, women, and youths, troubled by ugly, detracting, facial blemishes that beg for attention. Thousands of individuals cannot hold a cup of coffee or a pencil or a pen and vital physical activity is severely restricted by excruciating pain. Medical clinics are filled to capacity each day with victims, untimely inhibited by rheumatism, sore muscles, and joints. Simple fun and games no longer need be curtailed because of inflamed body joints. Nopeinne offers divine redemption to innocent victims of these ailments.

Market Trends

The consumers are seeking more natural products versus products containing artificial or chemical ingredients and to say wholesale trade is immense would be an understatement. The Department of Commerce's most recent Census of Wholesale Trade (1992) reports that merchant wholesalers handled nearly $1.9 trillion (58 percent) of the more than $3.3 trillion total wholesale trade sales. The industry's annual payroll in 1994 topped $127 billion, according to the National Association of Wholesaler-Distributors (NAW), and supplied salaries to more than 4.6 million individuals. All told, the inventories moved by wholesale distribution establishments were valued at more than $177 billion.

Market Growth

One of the more lucrative fields of proven endeavor is that of pharmaceuticals and related medical aids purchased by persons suffering from pain. A plethora of related complaints are documented each year by thousands of doctors and pharmacists. Recent government statistics disclose the fact that 43 million individuals suffer from arthritis while 20 to 40 percent of adults in this country are plagued by acne. Thirteen to fourteen million allergy sufferers were listed between 1990-1998 and 18 million are projected for 1999. Prescription drug sales gross up to $120 billion annually in America and that number is projected to double by 2004.

Caution, reluctance, or procrastination could be costly in this instance because statistically, the American consumer has proven to be reliable in terms of buying health products as rapidly as they are exposed to the marketplace. Consumer confidence in health products has never been higher.

Industry Analysis

The U.S. cosmetics market, measured in manufacturers' shipments, grew by more than $1 billion in 1998, at a rate of 6.6 percent. Growth was driven by color cosmetics with its focus on teens and 'tweens, and skincare with its dermal patches and pore strips, as well as the impact of niche lines with spa positioning. As for body and bath, there were a few cellulite or slimming body products and the bath market seemed close to saturation. Fragrance exhibited modest growth, fueled by classic scents and limited editions.

The skincare industry is characterized by a wide variety of companies ranging in size, from large companies such as St. Ives to smaller specialty firms such as ours. The companies are generally organized by either end-user markets or product technology. In the past decade there has been a general trend in the industry to change emphasis from using chemicals to all natural products. The cost of product development and the need to operate factories at high levels of capacity have caused skincare companies of every size to outsource parts of the skincare cream manufacturing processes. This has created opportunities for smaller companies to create and occupy niches in development and contract manufacturing.

An investment into health-related products has always been a wise and advantageous decision, simply because most Americans are prone to abusing and neglecting their bodies which frequently require costly adjustments to restore a reasonable degree of physical comfort. The American consumer spends $439 billion, $1.5 million annually for healthcare and health products ranging from dieting to exercise to painkillers, marketed for the purpose of securing relief, comfort, and improving physical appearance.

The longevity of the stock market is dependent on the continued desire and need of persons with surplus money to improve their financial status. LaBelle Industries, producer of Nopeinne, is a bonafide, newly organized and registered Michigan business with great potential by its very nature.

Industry Participants

LaBelle and Nopeinne are reaching out to special persons, seriously interested in a high-yielding financial investment. Opportunity is frequently unrecognized by persons preoccupied with other unrelated initiatives of lessor importance. Success, in many instances, is dependent on the willingness of one to take calculated risks of investing in reasonably assured fields of endeavor.

Physical Distribution

Once a sale is made, the product is shipped to the distribution point—our facility. We will be looking at setting up a drop-shipment so goods travel directly from the manufacturer to the customer. Our whole physical distribution process will be fueled by sales.

The following activities will be coordinated in order to physically move our product:

- Communication between order processing and physical distribution.

- Warehousing of finished product for distribution.

- Selection of transportation method to move the finished goods from warehouse.

- Handling the finished product at the distribution point.

We will also provide necessary delivery service to customers in a timely manner and keep costs under control.

Competition and Buying Patterns

Currently Celebrex and Vioxx cost more than $2 a pill, suggesting that the cost of a new pharmaceutical product is not an issue to persons seeking relief from pain. This inspired an impassioned Michigan vegetarian to create Nopeinne to relieve pain and suffering. Thus now poised to take its place in the marketplace is a new people-pleasing formula for relief.

Main Competitors

Our main skin cream competitors are: Tigerbalm, Flexall, Bengay, Heat, and Asper Cream.

Their shortcoming is that they contain more chemicals than the natural herbs and ingredients of Nopeinne.

Our main wholesale competitors will be power retailers who merge the specialty store concept with the discount store's emphasis on price. These retail warehouses are large stores with products displayed on metal racks in a warehouse setting. There are two distinct types of retail warehouses, the first being a membership and the second a consumer store which is open to the general public.

Their shortcoming, as with other competitors, is service; buyers must travel to them to pick up their goods. Some of the power retailers have just begun to offer delivery services, which is helping retailers to appreciate the value of using a distributor like LaBelle.

STRATEGY & IMPLEMENTATION SUMMARY

We address the market through one business segment: specialty skincare formulas. We are a niche player who has developed strong alliances with retailers who have powerful channel relationships.

Our marketing strategy assumes that we will serve our distributor by being a trade supplier, where we develop and sell our own lines of products based on industry and customer needs.

Our main strategy at LaBelle is to position ourselves at the top of the quality scale, featuring our combination of superb technology and rich, healthy herbs for the buyer who wants the best quality and best price. Tactics underneath that strategy include research and development related to new formulas and new products, choosing the right channels of distribution, and communicating our quality position to the market. Products are mainly those listed under the product description heading. We will continually develop new packaging, channel development, channel marketing programs, our direct sales, and our continued presence in high-end catalog channels and new presence on the web.

Value Proposition

LaBelle gives the skincare cream user, who cares about their skin features, a combination of the highest quality all-natural creams and the latest formulations at a relatively good price.

Competitive Edge

Our competitive edge is in the formulations and distributing processes we have developed for the production of the one product in which we specialize. As detailed above, we are in an excellent position to capture a significant part of the $123 billion-dollar skin cream market. We simply need to establish a marketing program and begin to promote our products.

Marketing Strategy

Our marketing strategy is to create effective advertisements made simple and which are easily understood, customer-oriented, truthful, informative, sincere, and will explain the who, what, when, where, why, and how of our business. Our advertising plan will instill a desire in people to consider our products and the value of our customer service and an inclination to do business with our company because of the positive messages they receive. Our good advertising will cause action and persuade the prospective customer to go with LaBelle instead of the competition.

We will use advertising to educate consumers who are buying from us. We expect our advertising, especially personal selling, has a cumulative effect. We are expecting the initial response to be slow, but to increase over time. We plan to advertise regularly and continuously on a small scale and then place large advertisements infrequently. By the same token, visiting and calling customers frequently helps to solidify relationships.

Word of mouth is essential to the growth of any business. We know the traditional forms of advertising play only a supporting role, and we will thrive or suffer from our reputation in the marketplace. We believe each satisfied customer has the potential to steer dozens of new ones to us, and each dissatisfied customer is equally capable of wreaking havoc on our business by planting doubt in the minds of existing customers and scaring off potential business.

Positioning Statements

For individuals who have suffered from facial scars, bumps, acne, or arthritis pain, LaBelle offers exquisite skin cream solutions. Unlike most skin cream manufacturers who use chemicals, LaBelle's all-natural products make no development compromises for standardization.

Pricing Strategy

We will maintain our pricing positions as a premier provider. We are the best product available from the most discriminating consumer. We intend to maintain our separation from the price competition at the lower end of the business. Our plan calls for no significant changes in pricing. Price increases will be due mostly to the fluctuation of our ingredient prices.

Promotion Strategy

Our promotion strategy is to first listen and observe our customers so we know what they consider paramount. We will then tell them how our products and services will supply solutions. We have kept in mind that retail businesses don't buy products and services; they buy the benefits that are derived from them, such as profit and support. As we continue to develop our planned strategy, we will clearly express and promote the features and functions of our products and services that satisfy the prospect's demands.

Our primary contact is the company's national or regional sales manager, or whoever is in charge of making inventory decisions. In entrepreneurial businesses like LaBelle, the owner is usually the sole decisionmaker.

We will also promote our products through seminars and home showings.

Distribution Strategy

Our distribution strategy is guided by security and control. LaBelle will personally deliver the products we buy and sell. We will deliver for security, to ensure the product's safe and timely delivery, and control, to be responsible for as much of the product's movement from the supplier to end user as possible, in order to provide a more comprehensive service and thereby increase revenues. Frankly, we don't want our customers knowing the identity of our manufacturer supplying our product.

Our distribution strategy is also guided by volume. The more the retailer buys, the lower our price. Our first opportunity to increase our margin by increasing our volume arises when we purchase our inventory from our manufacturer. If we can purchase inventory for ten retailers at a time instead of two, we will be devoting less of our money to our cost of goods sold and more to our business bank account. Buying in volume will also improve our relationship with our suppliers, it makes us a more valuable element of our customer base. The more we purchase, the more cost-saving opportunities will be offered to us.

Marketing Programs

Some of our marketing programs will include but will not be limited to:

- Free samples

- Coupons

- Referral Discounts

- Mailers

Sales Strategy

LaBelle's sales strategy includes using the following selling techniques:

- Telephone Sales

- Person-to-Person Sales

Our sales strategy is outlined below in three phases.

Phase One is to accommodate our existing customers and to make sure that current orders and subsequent orders are maintained.

Phase Two will commence when our facilities are expanded. We will then be able to develop new products, accept new clients, and contact companies who have shown interest in our products and be able to accommodate their orders. We plan to hire a high-quality salesperson to assist in defining our marketing program.

Phase Three will begin with the hiring of two additional sales representatives who will develop our consumer program wherein we will begin to sell our product directly to an individual via the web.

Savings will be our first transaction between the manufacturer and LaBelle. This is the arena in which price and profit do battle. Our ideal series of events is for LaBelle to pay as little as possible for the merchandise, control its distribution from the manufacturer to the customer/end user, and incur as few costs as possible in the process.

We will accept credit card, cash, and check sales. Later as we build cash-flow we will consider credit terms with 30-day invoices.

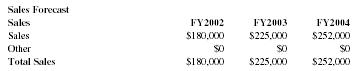

Sales Forecast

Our sales forecast is based on the selling of 5,000 units of the skin cream product. Four thousand units will be sold to retailers at an introductory wholesale price of $7.50 per unit, and 1,000 units will be sold directly to the consumers at $15 per unit. We expect our inventory to turn 4 times a year or every three months, forecasting revenue from sales to average approximately $45,000 per quarter. It costs $5.00 per unit to manufacture this product.

We are expecting to increase sales from $180,000 to $225,000 in the next year, which is slightly more than 24 percent growth. Growth forecast is relatively high for our industry because we are developing new patent formulas. In 2003 and 2004 we expect growth to increase 10 percent per year, to a projected total of $252,000 in 2004. We will spend approximately 30 percent of our original inventory investment to maintain or purchase additional inventory.

We are not projecting significant change in the products, or in the proportion between different products. Our seasonality, as shown in the chart, is still a factor in the business. Overall, sales tend to be steady.

| Sales Forecast | |||

| Sales | FY2002 | FY2003 | FY2004 |

| Sales | $180,000 | $225,000 | $252,000 |

| Other | $0 | $0 | $0 |

| Total Sales | $180,000 | $225,000 | $252,000 |

| Direct Cost of Sales | |||

| Sales | $22,500 | $36,000 | $39,600 |

| Other | $0 | $0 | $0 |

| Subtotal Cost of Sales | $22,500 | $36,000 | $39,600 |

Sales Programs

Specific sales programs:

- Distributor sales

- Web sales

- Retail sales

- Direct sales

- Telephone sales

Strategic Alliances

We depend on our alliance with Reuben Retro to generate continuous leads for our add-on products. We are also developing relationships with other manufacturers to further cut cost and continue sales growth.

MANAGEMENT SUMMARY

As the owner and manager of the business, Roman Miller will have complete control over every aspect of its structure and activity. He will handle daily operations himself. These operations include purchasing and order processing, controlling inventory, setting delivery schedules, defining return policies, and devising pricing methods.

We have a strong manager that can boast of years of experience in skin cream development. Roman has spent four years working and researching the skin cream industry. He has a proven background of expertise and is more than capable of transforming LaBelle into a leading specialty skin cream distributor.

Organizational Structure

Roman Miller, owner, is responsible for overall business management. We will utilize outside support resources as needed.

Management Team

We are currently developing the management team and more skin cream formulations to become a major player in the specialized niche we serve.

Management Team Gaps

We depend on our consultants that include our CPA and our attorney for some key management help. As we grow, we will develop more formulas and more mass production of those new products.

Personnel

Our present plan is to have one manager, Roman Miller. His job is to keep the office running efficiently, everything from scheduling future employees to monitoring deliveries and shipments to hiring and record keeping. He will not receive an owner's draw for the start-up phase of the business.

We are also looking to hire a Distribution Sales Representative (DSR) who will be a capable marketing professional with a background in skincare sales. Our DSR's duties include visiting prospects, discussing ideas for the prospects' purchases, taking notes regarding special product or service requests, providing customers with pricing information and estimates, and arranging for the signing of a contract, if necessary. We would like to bring that person on board late 2002.

Future personnel include one administrative support personnel, a bookkeeper. This bookkeeper will pay bills for inventory, equipment and supplies, as well as handle payroll and general bookkeeping. We will look for someone with basic computer and bookkeeping skills. Until we can hire a bookkeeper, we will utilize a good accounting software package.

We will not be offering any employee benefits for at least two years.

FINANCIAL PLAN

The financial picture is quite encouraging. We will be slow to take on debt over the next three years, but with our increase in sales we do expect to apply for a credit line with the bank in 2005 for expansion on our products and facilities.

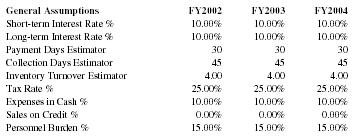

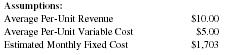

Important Assumptions

The assumptions that support our projections are:

The move to larger facilities at some point and the purchase of additional equipment will result in increased production. We have excellent agreements with our primary sources of supply and assume there will be no change in these relationships. We also assume that the demand for Nopeinne and our other products will continue to increase as evidenced in our market research.

On the flip side, another company could develop some of the formulas we have, in which case we would lose some of the technical and market advantage we now have. This will also decrease our valuation. If we cannot find a capable marketing person, who is both sales and technically savvy, in time to get into this market, we would be at a disadvantage. Technology changes, as do buying habits and social structure. But a degree of risk is synonymous to everything one does, so taking a chance is essential for success and perhaps survival. Even with a stagnated economy, we believe there will be little, if any, impact on individual desire to feel good and be free from physical pain and suffering, caused by neglect and/or deficient health care, thus continuing to purchase our products.

| General Assumptions | FY2002 | FY2003 | FY2004 |

| Short-term Interest Rate % | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate % | 10.00% | 10.00% | 10.00% |

| Payment Days Estimator | 30 | 30 | 30 |

| Collection Days Estimator | 45 | 45 | 45 |

| Inventory Turnover Estimator | 4.00 | 4.00 | 4.00 |

| Tax Rate % | 25.00% | 25.00% | 25.00% |

| Expenses in Cash % | 10.00% | 10.00% | 10.00% |

| Sales on Credit % | 0.00% | 0.00% | 0.00% |

| Personnel Burden % | 15.00% | 15.00% | 15.00% |

Risks

Developing a strong base of retailers and distributors, paying close attention to customer suggestions and requests, finding a small niche and sticking to what we know best, and coping with a changing economy are all proven ways to keep a wholesale distribution business successful and out of bankruptcy.

As in any business there are risks. Our goal is to recognize crucial warning signs and head off disasters by continually asking ourselves these questions:

- Are we carrying too many different kinds of products or stocking too much merchandise?

- Are we blinded by "pride of parenthood," failing to cut back on money-losing operations?

- Have we carefully analyzed demand for our products, monitored the marketplace, and adjusted quickly to changing conditions?

- Are some employees making little or no contribution to our bottom line?

- Are our profits declining despite increased sales, or is our inventory growing due to sliding sales figures?

- Have we prepared an accurate and realistic cash-flow projection?

- Are we maintaining unneeded warehouse or office space?

- Have we diversified away from our main strengths or overexpanded during good times, only to find ourself less liquid than we would like to be?

- Are we taking stopgap measures like injecting additional cash to meet accounts payable, payroll, and other expenses, rather than facing the real problems and taking the neccessary corrective steps?

Recognizing problems is a step in the right direction. The next step is to take action once we've diagnosed the problem so we can get our wholesale distribution business back on track. When deciding on our course of action, we will create and update an accurate and realistic cash-flow projection that takes into account changing economic realities, look at our operations on an overall basis instead of attacking cost-cutting piecemeal, and analyze both the short- and long-term effects of each cost-cutting activity.

We can avoid or overcome bankruptcy and failure by maintaining assiduous financial and operation control of our wholesale-distribution business, especially during the turbulent startup period, and we'll set ourselves on a path toward greater productivity and profitability. As we gain experience in the realms of wholesaling, merchandising, distributions and sales, and earn a reputation for providing top-quality customer service, good prices, and good products, we will develop specialized business skills which represent a comparative advantage over competitors in our area and beyond. Diligence and perseverance are as essential for success for a wholesaler or distributor as they are for any other line of work, and sound financial position is the necessary cornerstone for anyone interested in building a winning venture. That doesn't mean we will need millions of dollars; it means we must effectively manage the money we have, whatever the amount.

Break-even Analysis

The break-even analysis shows that LaBelle has a good balance of fixed costs and sufficient sales strength to remain healthy. Our goal is to sell at least 341 products per month or generate at lease $3,406 a month in sales.

| Break-even Analysis: | |

| Monthly Units Break-even | 341 |

| Monthly Sales Break-even | $3,406 |

| Assumptions: | |

| Average Per-Unit Revenue | $10.00 |

| Average Per-Unit Variable Cost | $5.00 |

| Estimated Monthly Fixed Cost | $1,703 |

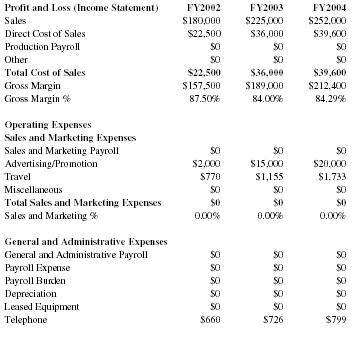

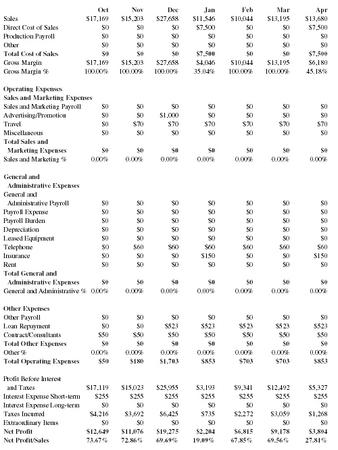

Projected Profit and Loss

This table shows we project a net profit of $108,552 by the end of 2002 and a gross margin of $212,400 by 2004. We hope to gain enough skills by 2004 to release our support consultant completely. The table also includes part of a repayment schedule of our $30,542 loan at 11 percent over a period of 7 years at approximately $523 per month including interest.

| Profit and Loss (Income Statement) | FY2002 | FY2003 | FY2004 |

| Sales | $180,000 | $225,000 | $252,000 |

| Direct Cost of Sales | $22,500 | $36,000 | $39,600 |

| Production Payroll | $0 | $0 | $0 |

| Other | $0 | $0 | $0 |

| Total Cost of Sales | $22,500 | $36,000 | $39,600 |

| Gross Margin | $157,500 | $189,000 | $212,400 |

| Gross Margin % | 87.50% | 84.00% | 84.29% |

| Operating Expenses | |||

| Sales and Marketing Expenses | |||

| Sales and Marketing Payroll | $0 | $0 | $0 |

| Advertising/Promotion | $2,000 | $15,000 | $20,000 |

| Travel | $770 | $1,155 | $1,733 |

| Miscellaneous | $0 | $0 | $0 |

| Total Sales and Marketing Expenses | $0 | $0 | $0 |

| Sales and Marketing % | 0.00% | 0.00% | 0.00% |

| General and Administrative Expenses | |||

| General and Administrative Payroll | $0 | $0 | $0 |

| Payroll Expense | $0 | $0 | $0 |

| Payroll Burden | $0 | $0 | $0 |

| Depreciation | $0 | $0 | $0 |

| Leased Equipment | $0 | $0 | $0 |

| Telephone | $660 | $726 | $799 |

| FY2002 | FY2003 | FY2004 | |

| Insurance | $450 | $600 | $600 |

| Rent | $0 | $0 | $0 |

| Total General and Administrative Expenses | $0 | $0 | $0 |

| General and Administrative % | 0.00% | 0.00% | 0.00% |

| Other Expenses | |||

| Other Payroll | $0 | $0 | $0 |

| Loan Repayment | $5,230 | $6,276 | $6,276 |

| Contract/Consultants | $600 | $300 | $0 |

| Total Other Expenses | $0 | $0 | $0 |

| Other % | 0.00% | 0.00% | 0.00% |

| Total Operating Expenses | $9,710 | $24,057 | $29,408 |

| Profit Before Interest and Taxes | $147,790 | $164,943 | $182,992 |

| Interest Expense Short-term | $3,054 | $3,054 | $3,054 |

| Interest Expense Long-term | $0 | $0 | $0 |

| Taxes Incurred | $36,184 | $40,472 | $44,984 |

| Extraordinary Items | $0 | $0 | $0 |

| Net Profit | $108,552 | $121,417 | $134,953 |

| Net Profit/Sales | 60.31% | 53.96% | 53.55% |

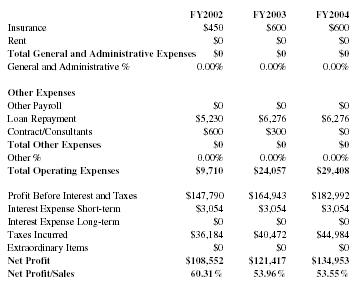

Projected Cash Flow

We expect to have a projected cash balance of $356,538 by 2004. In February of 2002 we anticipate a slight decrease in cash flow. Therefore we will heighten our telephone and person-to-person sales efforts beginning in December 2001 to strengthen January 2002 and February 2002 sales and cash flow.

| Projected Cash Flow | FY2002 | FY2003 | FY2004 |

| Net Profit | $108,552 | $121,417 | $134,953 |

| Plus: | |||

| Depreciation | $0 | $0 | $0 |

| Change in Accounts Payable | $3,528 | $5,554 | ($164) |

| Current Borrowing (repayment) | $0 | $0 | $0 |

| Increase (decrease) Other Liabilities | $0 | $0 | $0 |

| Long-term Borrowing (repayment) | $0 | $0 | $0 |

| Capital Input | $0 | $0 | $0 |

| Subtotal | $112,104 | $123,897 | $135,137 |

| Less: | |||

| Change in Accounts Receivable | $0 | $0 | $0 |

| Change in Inventory | ($2,500) | $13,500 | $3,600 |

| Change in Other Short-term Assets | $0 | $0 | $0 |

| Capital Expenditure | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal | ($2,500) | $13,500 | $3,600 |

| Net Cash Flow | $114,604 | $110,397 | $131,537 |

| Cash Balance | $114,604 | $225,001 | $356,538 |

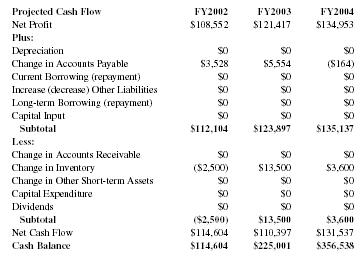

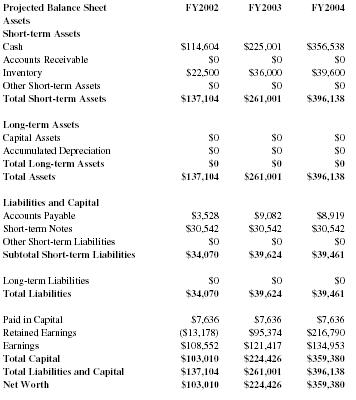

Projected Balance Sheet

As shown in the balance sheet in the following table, we expect a projected healthy growth in net worth, from approximately $103,010 from 2002 to more than $359,380 by the end of 2004. The monthly projections are in the appendices.

| Projected Balance Sheet | FY2002 | FY2003 | FY2004 |

| Assets | |||

| Short-term Assets | |||

| Cash | $114,604 | $225,001 | $356,538 |

| Accounts Receivable | $0 | $0 | $0 |

| Inventory | $22,500 | $36,000 | $39,600 |

| Other Short-term Assets | $0 | $0 | $0 |

| Total Short-term Assets | $137,104 | $261,001 | $396,138 |

| Long-term Assets | |||

| Capital Assets | $0 | $0 | $0 |

| Accumulated Depreciation | $0 | $0 | $0 |

| Total Long-term Assets | $0 | $0 | $0 |

| Total Assets | $137,104 | $261,001 | $396,138 |

| Liabilities and Capital | |||

| Accounts Payable | $3,528 | $9,082 | $8,919 |

| Short-term Notes | $30,542 | $30,542 | $30,542 |

| Other Short-term Liabilities | $0 | $0 | $0 |

| Subtotal Short-term Liabilities | $34,070 | $39,624 | $39,461 |

| Long-term Liabilities | $0 | $0 | $0 |

| Total Liabilities | $34,070 | $39,624 | $39,461 |

| Paid in Capital | $7,636 | $7,636 | $7,636 |

| Retained Earnings | ($13,178) | $95,374 | $216,790 |

| Earnings | $108,552 | $121,417 | $134,953 |

| Total Capital | $103,010 | $224,426 | $359,380 |

| Total Liabilities and Capital | $137,104 | $261,001 | $396,138 |

| Net Worth | $103,010 | $224,426 | $359,380 |

This page left intentionally blank to accommodate tabular matter following.

APPENDIX

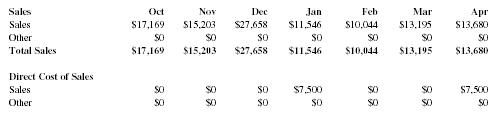

Sales Forecast

| Sales | Oct | Nov | Dec | Jan | Feb | Mar | Apr |

| Sales | $17,169 | $15,203 | $27,658 | $11,546 | $10,044 | $13,195 | $13,680 |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Sales | $17,169 | $15,203 | $27,658 | $11,546 | $10,044 | $13,195 | $13,680 |

| Direct Cost of Sales | |||||||

| Sales | $0 | $0 | $0 | $7,500 | $0 | $0 | $7,500 |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

General Assumptions

| General Assumptions | Oct | Nov | Dec | Jan | Feb | Mar | Apr |

| Short-term Interest Rate % | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate % | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% |

| Payment Days Estimator | 30 | 30 | 30 | 30 | 30 | 30 | 30 |

| Collection Days Estimator | 45 | 45 | 45 | 45 | 45 | 45 | 45 |

| Inventory Turnover Estimator | 4.00 | 4.00 | 4.00 | 4.00 | 4.00 | 4.00 | 4.00 |

| Tax Rate % | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% |

| Expenses in Cash % | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% |

| Sales on Credit % | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Personnel Burden % | 15.00% | 15.00% | 15.00% | 15.00% | 15.00% | 15.00% | 15.00% |

| May | Jun | Jul | Aug | Sep | FY2002 | FY2003 | FY2004 |

| $17,048 | $13,320 | $12,822 | $14,968 | $13,348 | $180,000 | $225,000 | $252,000 |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| $17,048 | $13,320 | $12,822 | $14,968 | $13,348 | $180,000 | $225,000 | $252,000 |

| $0 | $0 | $7,500 | $0 | $0 | $22,500 | $36,000 | $39,600 |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| May | Jun | Jul | Aug | Sep | FY2002 | FY2003 | FY2004 |

| 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% |

| 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% |

| 30 | 30 | 30 | 30 | 30 | 30 | 30 | 30 |

| 45 | 45 | 45 | 45 | 45 | 45 | 45 | 45 |

| 4.00 | 4.00 | 4.00 | 4.00 | 4.00 | 4.00 | 4.00 | 4.00 |

| 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% |

| 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% |

| 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| 15.00% | 15.00% | 15.00% | 15.00% | 15.00% | 15.00% | 15.00% | 15.00% |

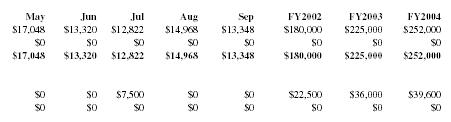

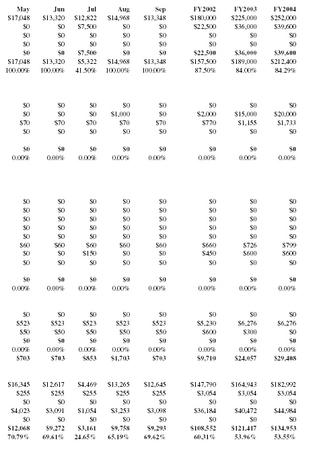

Profit and Loss (Income Statement)

| Oct | Nov | Dec | Jan | Feb | Mar | Apr | |

| Sales | $17,169 | $15,203 | $27,658 | $11,546 | $10,044 | $13,195 | $13,680 |

| Direct Cost of Sales | $0 | $0 | $0 | $7,500 | $0 | $0 | $7,500 |

| Production Payroll | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Cost of Sales | $0 | $0 | $0 | $7,500 | $0 | $0 | $7,500 |

| Gross Margin | $17,169 | $15,203 | $27,658 | $4,046 | $10,044 | $13,195 | $6,180 |

| Gross Margin % | 100.00% | 100.00% | 100.00% | 35.04% | 100.00% | 100.00% | 45.18% |

| Operating Expenses | |||||||

| Sales and Marketing Expenses | |||||||

| Sales and Marketing Payroll | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Advertising/Promotion | $0 | $0 | $1,000 | $0 | $0 | $0 | $0 |

| Travel | $0 | $70 | $70 | $70 | $70 | $70 | $70 |

| Miscellaneous | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Sales and Marketing Expenses | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Sales and Marketing % | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| General and Administrative Expenses | |||||||

| General and Administrative Payroll | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Payroll Expense | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Payroll Burden | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Depreciation | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Leased Equipment | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Telephone | $0 | $60 | $60 | $60 | $60 | $60 | $60 |

| Insurance | $0 | $0 | $0 | $150 | $0 | $0 | $150 |

| Rent | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total General and Administrative Expenses | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| General and Administrative % | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Other Expenses | |||||||

| Other Payroll | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Loan Repayment | $0 | $0 | $523 | $523 | $523 | $523 | $523 |

| Contract/Consultants | $50 | $50 | $50 | $50 | $50 | $50 | $50 |

| Total Other Expenses | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Other % | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Total Operating Expenses | $50 | $180 | $1,703 | $853 | $703 | $703 | $853 |

| Profit Before Interest and Taxes | $17,119 | $15,023 | $25,955 | $3,193 | $9,341 | $12,492 | $5,327 |

| Interest Expense Short-term | $255 | $255 | $255 | $255 | $255 | $255 | $255 |

| Interest Expense Long-term | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Taxes Incurred | $4,216 | $3,692 | $6,425 | $735 | $2,272 | $3,059 | $1,268 |

| Extraordinary Items | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Net Profit | $12,649 | $11,076 | $19,275 | $2,204 | $6,815 | $9,178 | $3,804 |

| Net Profit/Sales | 73.67% | 72.86% | 69.69% | 19.09% | 67.85% | 69.56% | 27.81% |

| May | Jun | Jul | Aug | Sep | FY2002 | FY2003 | FY2004 |

| $17,048 | $13,320 | $12,822 | $14,968 | $13,348 | $180,000 | $225,000 | $252,000 |

| $0 | $0 | $7,500 | $0 | $0 | $22,500 | $36,000 | $39,600 |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| $0 | $0 | $7,500 | $0 | $0 | $22,500 | $36,000 | $39,600 |

| $17,048 | $13,320 | $5,322 | $14,968 | $13,348 | $157,500 | $189,000 | $212,400 |

| 100.00% | 100.00% | 41.50% | 100.00% | 100.00% | 87.50% | 84.00% | 84.29% |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| $0 | $0 | $0 | $1,000 | $0 | $2,000 | $15,000 | $20,000 |

| $70 | $70 | $70 | $70 | $70 | $770 | $1,155 | $1,733 |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| $60 | $60 | $60 | $60 | $60 | $660 | $726 | $799 |

| $0 | $0 | $150 | $0 | $0 | $450 | $600 | $600 |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| $523 | $523 | $523 | $523 | $523 | $5,230 | $6,276 | $6,276 |

| $50 | $50 | $50 | $50 | $50 | $600 | $300 | $0 |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| $703 | $703 | $853 | $1,703 | $703 | $9,710 | $24,057 | $29,408 |

| $16,345 | $12,617 | $4,469 | $13,265 | $12,645 | $147,790 | $164,943 | $182,992 |

| $255 | $255 | $255 | $255 | $255 | $3,054 | $3,054 | $3,054 |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| $4,023 | $3,091 | $1,054 | $3,253 | $3,098 | $36,184 | $40,472 | $44,984 |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| $12,068 | $9,272 | $3,161 | $9,758 | $9,293 | $108,552 | $121,417 | $134,953 |

| 70.79% | 69.61% | 24.65% | 65.19% | 69.62% | 60.31% | 53.96% | 53.55% |

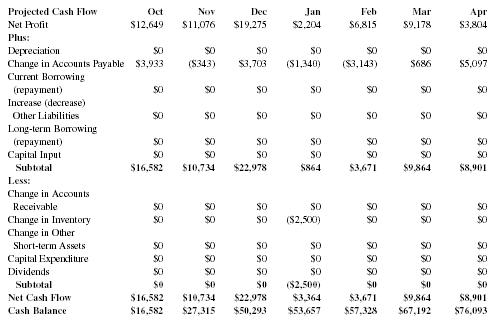

Projected Cash Flow

| Oct | Nov | Dec | Jan | Feb | Mar | Apr | |

| Net Profit | $12,649 | $11,076 | $19,275 | $2,204 | $6,815 | $9,178 | $3,804 |

| Plus: | |||||||

| Depreciation | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Change in Accounts Payable | $3,933 | ($343) | $3,703 | ($1,340) | ($3,143) | $686 | $5,097 |

| Current Borrowing (repayment) | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Increase (decrease) Other Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Long-term Borrowing (repayment) | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Capital Input | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal | $16,582 | $10,734 | $22,978 | $864 | $3,671 | $9,864 | $8,901 |

| Less: | |||||||

| Change in Accounts Receivable | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Change in Inventory | $0 | $0 | $0 | ($2,500) | $0 | $0 | $0 |

| Change in Other Short-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Capital Expenditure | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal | $0 | $0 | $0 | ($2,500) | $0 | $0 | $0 |

| Net Cash Flow | $16,582 | $10,734 | $22,978 | $3,364 | $3,671 | $9,864 | $8,901 |

| Cash Balance | $16,582 | $27,315 | $50,293 | $53,657 | $57,328 | $67,192 | $76,093 |

| May | Jun | Jul | Aug | Sep | FY2002 | FY2003 | FY2004 |

| $12,068 | $9,272 | $3,161 | $9,758 | $9,293 | $108,552 | $121,417 | $134,953 |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| ($4,259) | ($811) | $4,883 | ($3,872) | ($1,005) | $3,528 | $5,554 | ($164) |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| $7,809 | $8,461 | $8,044 | $5,885 | $8,288 | $112,080 | $126,971 | $134,790 |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| $0 | $0 | $0 | $0 | $0 | ($2,500) | $13,500 | $3,600 |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| $0 | $0 | $0 | $0 | $0 | ($2,500) | $13,500 | $3,600 |

| $7,809 | $8,461 | $8,044 | $5,885 | $8,288 | $114,580 | $113,471 | $131,190 |

| $83,902 | $92,363 | $100,407 | $106,292 | $114,580 | $114,580 | $228,051 | $359,240 |

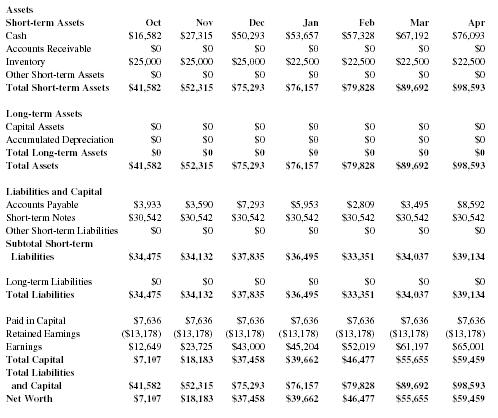

Projected Balance Sheet

| Assets | |||||||

| Short-term Assets | Oct | Nov | Dec | Jan | Feb | Mar | Apr |

| Cash | $16,582 | $27,315 | $50,293 | $53,657 | $57,328 | $67,192 | $76,093 |

| Accounts Receivable | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Inventory | $25,000 | $25,000 | $25,000 | $22,500 | $22,500 | $22,500 | $22,500 |

| Other Short-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Short-term Assets | $41,582 | $52,315 | $75,293 | $76,157 | $79,828 | $89,692 | $98,593 |

| Long-term Assets | |||||||

| Capital Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Accumulated Depreciation | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Assets | $41,582 | $52,315 | $75,293 | $76,157 | $79,828 | $89,692 | $98,593 |

| Liabilities and Capital | |||||||

| Accounts Payable | $3,933 | $3,590 | $7,293 | $5,953 | $2,809 | $3,495 | $8,592 |

| Short-term Notes | $30,542 | $30,542 | $30,542 | $30,542 | $30,542 | $30,542 | $30,542 |

| Other Short-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Short-term Liabilities | $34,475 | $34,132 | $37,835 | $36,495 | $33,351 | $34,037 | $39,134 |

| Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Liabilities | $34,475 | $34,132 | $37,835 | $36,495 | $33,351 | $34,037 | $39,134 |

| Paid in Capital | $7,636 | $7,636 | $7,636 | $7,636 | $7,636 | $7,636 | $7,636 |

| Retained Earnings | ($13,178) | ($13,178) | ($13,178) | ($13,178) | ($13,178) | ($13,178) | ($13,178) |

| Earnings | $12,649 | $23,725 | $43,000 | $45,204 | $52,019 | $61,197 | $65,001 |

| Total Capital | $7,107 | $18,183 | $37,458 | $39,662 | $46,477 | $55,655 | $59,459 |

| Total Liabilities and Capital | $41,582 | $52,315 | $75,293 | $76,157 | $79,828 | $89,692 | $98,593 |

| Net Worth | $7,107 | $18,183 | $37,458 | $39,662 | $46,477 | $55,655 | $59,459 |

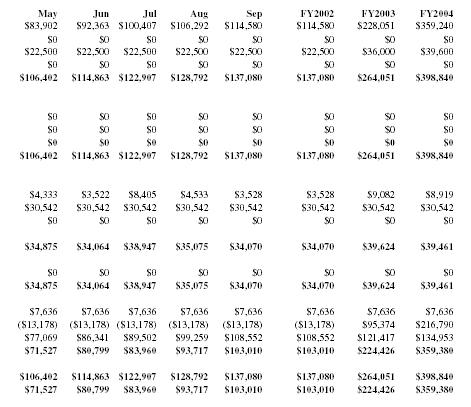

| May | Jun | Jul | Aug | Sep | FY2002 | FY2003 | FY2004 |

| $83,902 | $92,363 | $100,407 | $106,292 | $114,580 | $114,580 | $228,051 | $359,240 |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| $22,500 | $22,500 | $22,500 | $22,500 | $22,500 | $22,500 | $36,000 | $39,600 |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| $106,402 | $114,863 | $122,907 | $128,792 | $137,080 | $137,080 | $264,051 | $398,840 |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| $106,402 | $114,863 | $122,907 | $128,792 | $137,080 | $137,080 | $264,051 | $398,840 |

| $4,333 | $3,522 | $8,405 | $4,533 | $3,528 | $3,528 | $9,082 | $8,919 |

| $30,542 | $30,542 | $30,542 | $30,542 | $30,542 | $30,542 | $30,542 | $30,542 |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| $34,875 | $34,064 | $38,947 | $35,075 | $34,070 | $34,070 | $39,624 | $39,461 |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| $34,875 | $34,064 | $38,947 | $35,075 | $34,070 | $34,070 | $39,624 | $39,461 |

| $7,636 | $7,636 | $7,636 | $7,636 | $7,636 | $7,636 | $7,636 | $7,636 |

| ($13,178) | ($13,178) | ($13,178) | ($13,178) | ($13,178) | ($13,178) | $95,374 | $216,790 |

| $77,069 | $86,341 | $89,502 | $99,259 | $108,552 | $108,552 | $121,417 | $134,953 |

| $71,527 | $80,799 | $83,960 | $93,717 | $103,010 | $103,010 | $224,426 | $359,380 |

| $106,402 | $114,863 | $122,907 | $128,792 | $137,080 | $137,080 | $264,051 | $398,840 |

| $71,527 | $80,799 | $83,960 | $93,717 | $103,010 | $103,010 | $224,426 | $359,380 |

thanks!